flow through entity example

Partnerships file an entity -level tax. Federal income tax purposes or subject to.

Michigan Flow Through Tax Act Webinar Youtube

Given that it is a partnership the income to each owner will be half of 80000 both will report an incom See more.

. Flow Through Entity means an entity that is treated as a partnership not taxable as a corporation a grantor trust or a disregarded entity for US. Example - How to use. The firm is considered a pass-through entity.

A flow-through entity also known as a pass-through entity or fiscally-transparent entity is a legal business entity where its profits flow directly to the investorsowners and only. The Termbase team is compiling practical examples in using. If a partner is a foreign flow-through entity or a foreign intermediary you apply the payee determination rules to that partner to determine the payees.

The following types of common flow. The UK treats the US LLC as an opaque entity and would subject it to corporation tax. A manufacturing partnership firm distributes its income entirely to its partners.

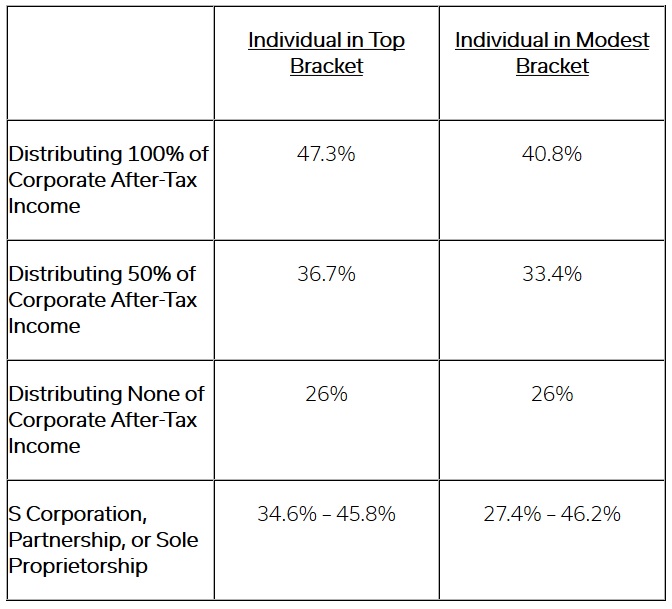

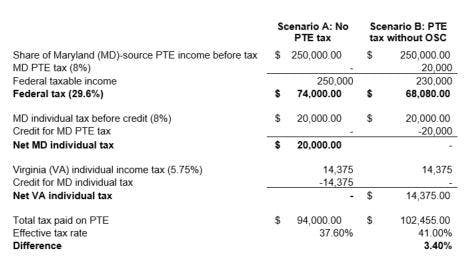

Larry a 50 shareholder. Examples of flow-through or pass-through entities are S corporations limited liability companies LLCs partnerships and sole proprietorships. For example some of you may have profitable flow-through entities that generate taxable income but historically you pay very little Michigan income tax due to PA-116 credits.

Company X is owned by two businessmen in Los Angeles. For example take a US LLC that is treated as transparent in the US but assume it is tax resident in the UK. PASS-THROUGH ENTITY TAX.

A flow-through entity is a legal business entity that passes income on to the owners andor investors of the business. For example- new_account_target to new_account_targetset. Examples of Pass-Through Entity Example 1.

Although this flow-through entitys members may report their. For example a flow-through entity that elects into tax year 2021 on March 31 2022 pays all tax due for the year on that date. Examples of flow-through or pass-through entities are S corporations limited liability companies LLCs partnerships and sole proprietorships.

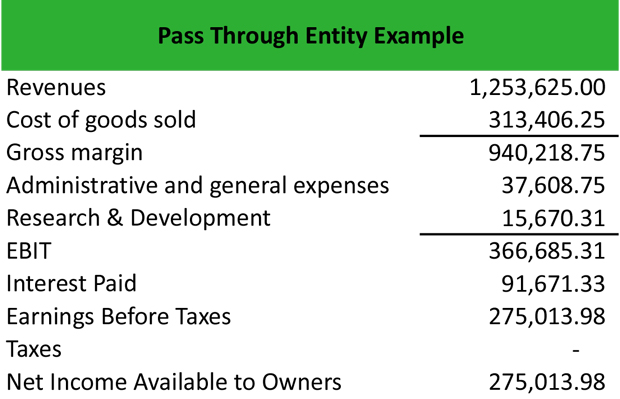

The basic financials of X are as follows. Consequently what is a flow through entity for tax purposes. 3 Go to your custom flow paste Relationship Entity Name in the entity.

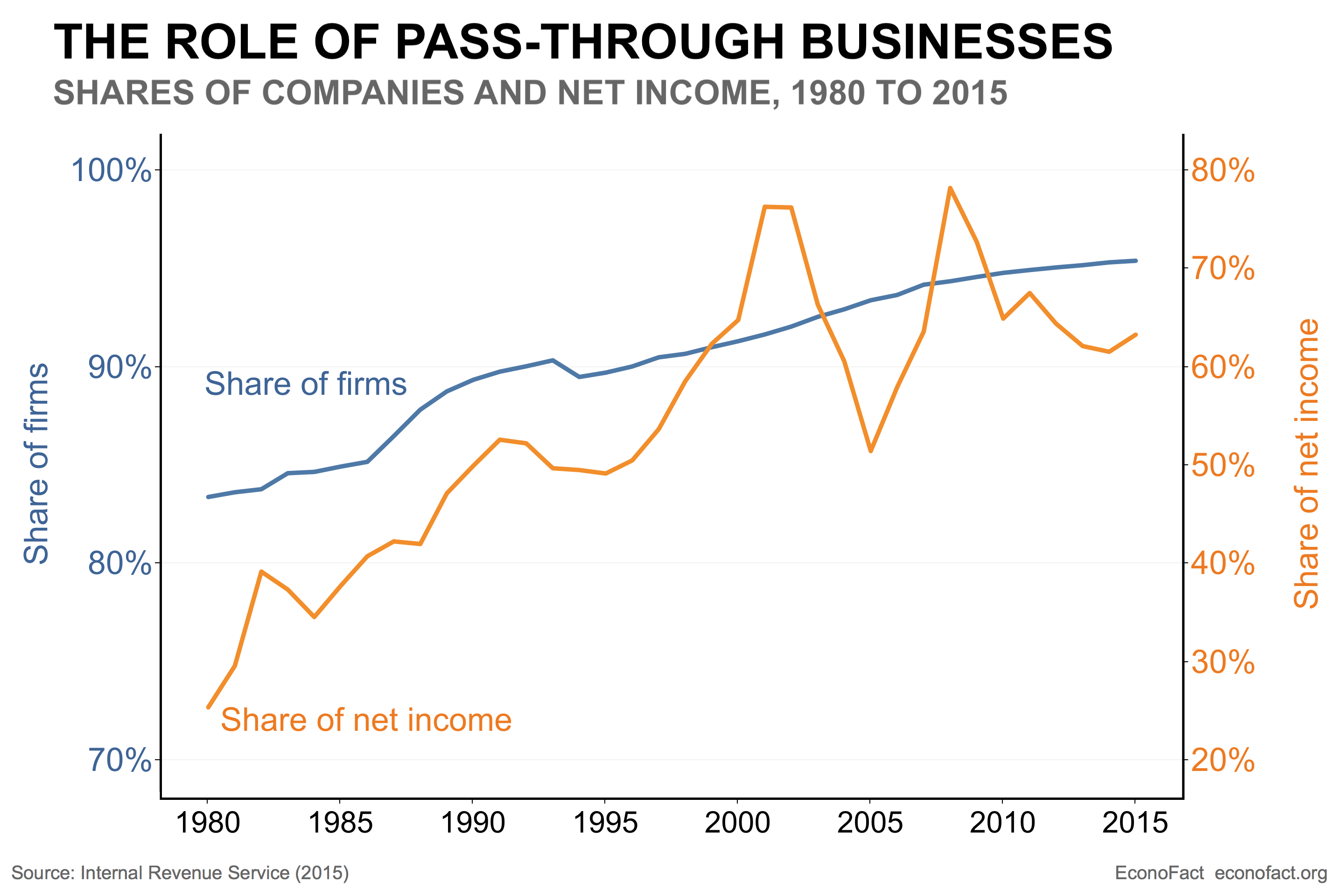

Businesses were organized as flow-through entities in 2012up from 49 percent in 1985 figure 1. Flow-Through Entity is an example of a term used in the field of economics Taxes - Income Tax. An entity such as a limited liability company.

During that same period the share of business receipts going to flow-through entities. A flow-through entity is a legal entity where income flows through to investors or owners. Chantelle is a 20 shareholder.

Since it is a flow-through entity the owners must report their earnings as income when filing personal income taxes. A hybrid entity for this purpose is an entity that two contracting States that are parties to a bilateral tax treaty characterize differently eg. That is the income of the entity is treated as the income of the investors or owners.

Chantelle Larry and Ryan are shareholders in the Triple Lucky S corporation.

Improve Christmas Tree Farm Cash Flow By Paying Estimated Taxes At The Right Time Andrew Bosserman Cpa

What Is A Pass Through Entity Definition Meaning Example

5 New Tax Charts International Tax Blog

9 Facts About Pass Through Businesses

Sweeping Tax Reform Necessitates Review And Analysis Of Form Of Entity United States

4 Types Of Business Structures And Their Tax Implications Netsuite

Pass Through Entity Tax Rules Pte Taxes Washington Dc Cpa

What Are The Benefits Of Pass Through Taxation Legalzoom

Pass Through Entity Avoiding Double Taxation Of Business Income

Flow Through Entities Income Taxes 2018 2019 Youtube

What Is A Pass Through Entity Northwest Registered Agent

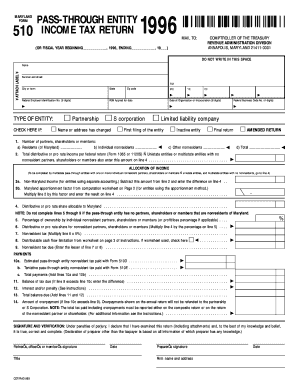

Fillable Online Maryland Part Year Resident Pass Through Entity Form Fax Email Print Pdffiller

Pass Through Entity Tax 101 Baker Tilly

Choice Of Entity Choosing The Right Business Structure

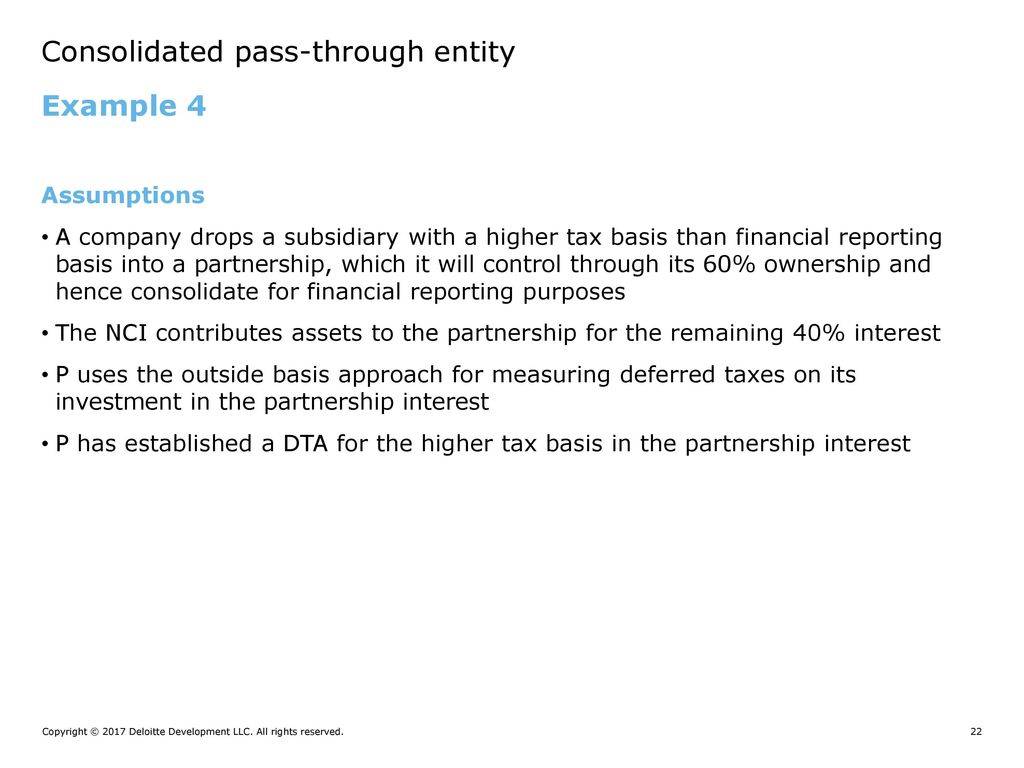

Accounting For Investments In Pass Through Entities Ppt Download

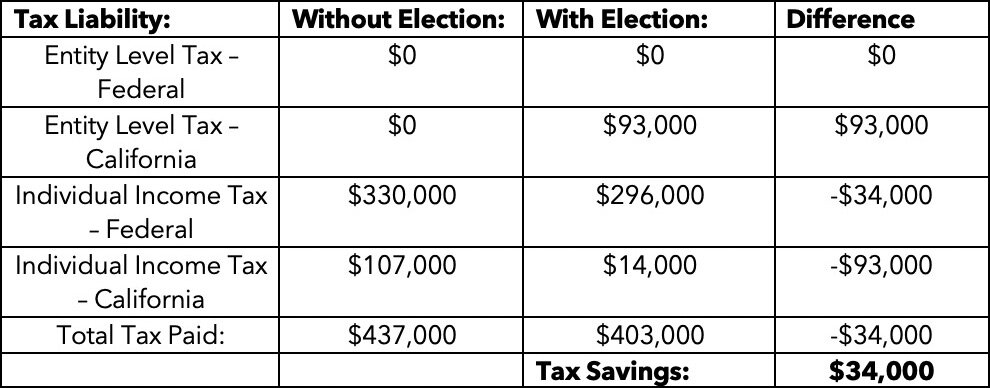

California Sidesteps The Federal 10 000 State And Local Tax Deduction Cap Hafuta Law

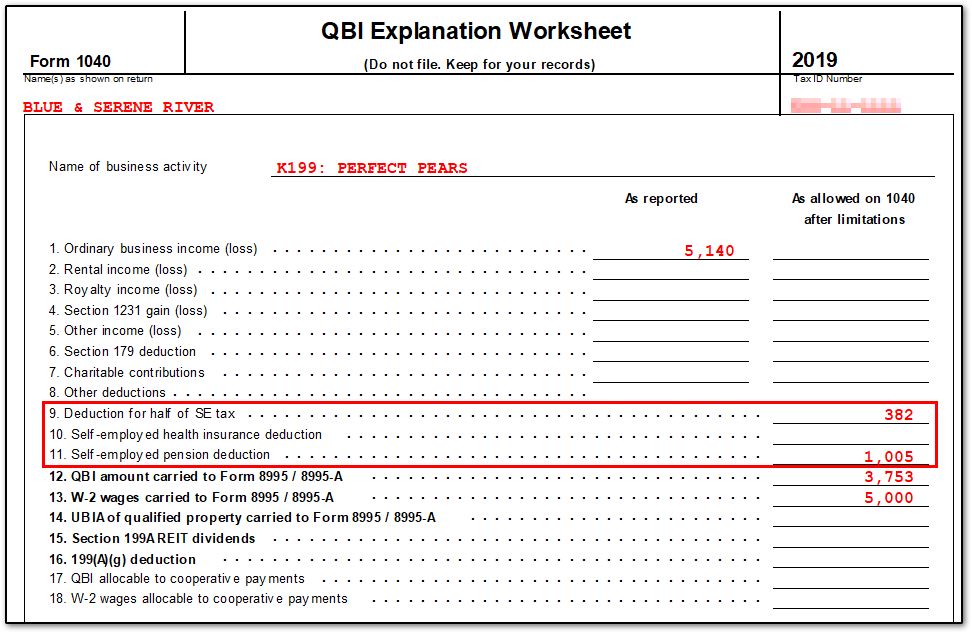

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

Double Taxation Of Corporate Income In The United States And The Oecd

Example For The Modeling Of The Entity Flow Within A Terminal Module Download Scientific Diagram